Ifsc Code Dana Adalah

Daftar Tabel IFSC Code

Tabel IFSC Code berisi daftar lengkap kode IFSC untuk berbagai bank dan cabang di India. Tabel ini mencakup informasi penting yang diperlukan saat melakukan transaksi keuangan.

Sebelum melakukan transaksi, pastikan kode IFSC kalian benar! Untuk memastikan bahwa Kode IFSC yang kalian gunakan benar, kalian dapat klik link berikut untuk memvalidasi kode IFSC kalian: Validasi Kode IFSC

Sekarang kalian telah memiliki pengetahuan yang lebih dalam mengenai IFSC Code, dan sekarang kalian mengetahui bahwa IFSC Code merupakan suatu aspek penting dalam transaksi perbankan India. Untuk kirim uang ke India, Anda bisa gunakan Easylink sebagai Platform Transfer uang ke luar negeri.

Latest posts by Amanda Kayla Alika

Maaf, sedang ada perbaikan nih

Saat ini kami sedang melakukan pemeliharaan di Pusat Bantuan Flip. Namun jangan khawatir, kamu tetap bisa chat dengan Tim Flip kok.

Muat UlangChat Dengan Tim FlipKembali ke Beranda

Ever wondered what IFSC printed on our passbook/chequebook stands for, and what is its significance in the Indian banking sector? Let’s find out everything about it.

Most of us are familiar with the Indian Financial System Code or IFSC that is used for electronic money transfers. Yes, we are referring to the alpha-numeric code printed on bank documents like the front leaf of the passbook and the chequebook. But do you know what is an IFSC and why is it important for carrying out banking transactions? Here's all you need to know about it.

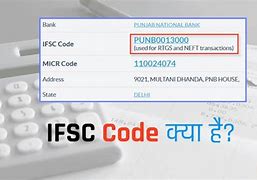

IFSC is an important part of the Indian banking infrastructure. It is a unique 11-digit number issued by the Reserve Bank of India (RBI), for identifying an individual bank and its specific branch. The format of IFSC is such, wherein the first four characters represent the bank's name, and the last six digits (combination of alphabets and numerals) indicate the location of the branch. The fifth character is zero and remains constant for all codes.

The first 4 alphabets (ICIC) in the above example serve to identify the bank, in this case - ICICI, and the last 6 digits (000053) represent its Jayanagar branch, in Bangalore.

It must be noted that no two banks or branches have the same code. In fact, the IFSC is different even for two accounts held in two different branches of the same bank. The RBI website has a list of all the banks and their IFSC.

What is the significance of IFSC?

The importance of the IFSC code cannot be stressed enough. It has made online transferring of funds easy, secure and accessible for all. Listed below, are some of the benefits it bestows:

IFSC ensures that fund transfers between banks are carried out seamlessly, without any blunders. The identification code can help RBI track, monitor, oversee, as well as authenticate all financial transactions conducted through modes such as the National Electronic Fund Transfer (NEFT), Real Time Gross Settlement (RTGS) and Immediate Payment Service (IMPS).

IFSC plays a pivotal role in transferring money efficiently, from one bank account to another. It helps in determining the source as well as the recipient bank branch.

Since a valid IFSC is vital for initiating Fund Transfers through Net Banking, the online platform has become extremely safe. IFSC eliminates the odds of fraud, error, or theft during the Fund Transfer process.

Due to IFSC, the procedure of carrying out financial transactions, has not only become convenient but also picked up pace. Funds can be transferred in just a few minutes, from any corner of the globe. This is a boon for those in dire need of funds, due to a financial emergency.

Financial transactions through electronic modes are paperless. Thanks to IFSC, account-holders are doing their bit for Mother Earth, by using eco-friendly measures for money transfer.

As a rule, the IFSC cannot be changed, revised or updated. However, in the event of a merger or reorganisation of the bank, the IFSC identification code changes. In this case, the account holder is issued a new code. This is to ensure the online financial transaction is successful and it reaches the beneficiary's account, without any glitch.

As you can see, the IFSC code is an integral part of the modern banking system. Apart from making Internet Banking quick, safe, and convenient, it also indirectly contributes to a greener environment.

Terms and Conditions apply.

For disclaimer, Click Here.

Step 3: System Validates the Branch Code

Identifikasi Cabang Tertentu

Setiap karakter dalam IFSC Code memiliki makna penting. 4 karakter pertama mengidentifikasi bank, karakter kelima selalu angka “0”, dan 6 karakter terakhir mengidentifikasi cabang tertentu dari bank tersebut.

Razorpay’s IFSC Toolkit

Handling a multitude of payments on an everyday basis, we discovered that we needed to process, validate and query several financial details, one of them being IFSC codes. We needed a system that could, easily, quickly, and accurately validate codes in order to ensure smooth payments processing. Without any complete API that suited all our requirements, we decided to build our own IFSC toolkit and even make it open source to help others in the industry.

Here’s exactly how we built the IFSC Toolkit:

The IFSC toolkit includes an API, the dataset downloads, and the source code to generate the entire dataset from the RBI website. You can find all these details at ifsc.razorpay.com. We have written more about Razorpay IFSC Toolkit.

Features of IFSC Codes

Step 5: Transaction Completion and Monitoring

IFSC codes are essential for both fund transfers and investments like mutual funds or insurance, where it ensures that funds are routed to the right accounts. Always double-check the IFSC before confirming any transaction to avoid delays or errors.

Can I transfer money without an IFSC code?

No. This code is mandatory for conducting online transactions through NEFT, IMPS or RTGS.

Step 1: Verify the IFSC Code

Is it safe to share IFSC Code?

Yes, it is safe to share your bank IFSC. The transaction can only be completed if the other person knows your bank account number, name and IFSC.

What is an IFSC Code?

The full form of IFSC is Indian Financial System Code. It is an 11-digit alphanumeric code unique to each bank branch in India, which is used for online money transfers through National Electronic Funds Transfer (NEFT), Real Time Gross Settlement (RTGS), and Immediate Payment Service (IMPS) systems. IFSC helps identify the source and destination bank branches for transactions.

Related Read: What is the Difference Between IMPS and NEFT Fund Transfer?